-

Posts

5,044 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Shop

Articles

Everything posted by Leonard Smalls

-

What are you listening to right now?

Leonard Smalls replied to Sarah5string's topic in General Discussion

You're not wrong - these guys make most bands, not just 2 pieces, look like rank amateurs! Triple post... -

What are you listening to right now?

Leonard Smalls replied to Sarah5string's topic in General Discussion

See whole concert on previous page! -

What are you listening to right now?

Leonard Smalls replied to Sarah5string's topic in General Discussion

Aye - it's rare that I'll watch all the way through a concert video without skipping or worrying about the other stuff I'm meant to be doing! -

What are you listening to right now?

Leonard Smalls replied to Sarah5string's topic in General Discussion

Some crazy Canadian mathtyperock... -

Not sure bandmates will want to call it the "Don't e.p."! Or are you saying we should spare the world the pain of releasing an obviously disturbing racket into an already shattered world? Though that could also be a good title, in the spirit of Iain M Banks!

-

Beelzebubble Life - Squarepusher

-

In Glorious Times had been suggested - but liking the deletion of an unnecessary space!

-

My very long-running band (40 years, on and off!) are about to release our second ep... The first one was just named after one of the tracks (Feed The Creature), but we feel that we could have something a bit more descriptive of all the tracks, or at least summat witty. Currently the holding title is "Glorious Times" (after one of the tracks - other tracks are "Penny Arcade", "Tall Buildings" and "(I bit my) Mother Tongue"). Any thoughts? We're sort of EDM Funk Rock - Spotty link below to first ep. Suggestions have been "It's All Bollocks, Never Mind" (!), "Best Enjoyed In Retrospect?", "Pot Holes Present Challenge" (?) and "The Deva Sessions" (songs were written especially for a gig (rare!) in Chester...

-

Negativ Nein - Einstürzende Neubauten

-

White Lines - Grandmaster Flash and the Furious Five

-

To be fair, not every Porky Prime Cut sounds good, I spose they did the best they could and scrawled their X on it! And most of the singles I've got from that period were Porky's so I thought he only did good stuff, ie what I liked. Seemed just about every decent punk and new wave record was a Porky!

-

It's the old "Garbage In, Garbage Out" ... If it's a poor recording and/or a poor pressing it's never going to sound good! Saying that, I occasionally have a singles night (!) where I flop out my 7 inchers from the late 70s/early 80s, and while not having the absolute fidelity of something like Al McDowell's Time Peace, or Nazaire's"Who's blues?", they don't sound bad at all, especially things like The Monochrome Set's "He's Frank" or DAF's "Kebabtraume"... They, however, have the immortal words scratched into the end groove - "a Porky Prime Cut". Always wanted to have a record of my own mastered by Porky!

-

Seems like a weird option in an amp! A pure class A amp is generally just that, because they're so inefficient and run so hot they tend to be only 20-30w (like the MF A1, or Sugden Masterclass - they're excellent, btw!). More powerful class As like some of the Pass Labs offerings are enormous and expensive beasts! A well designed class AB will run in class A for about 10% of it's rated power - frinstance my Bryston uses class A for the first 90w, the following 850w are in B... And as any fule knowz, you need power for proper bass reproduction!

-

Operator -Midnight Star

-

There's sound reasons for using a separate power amp - keeping low level signal processing away from high power amplification can lead to big (ISH!) gains in fidelity... I even do this with my bass set up, though I use a PA power amp rather than bass-specific. At one time I even used a passive pre-amp (some swear by 'em) though that was only because it came with a pair of Lumley 120w valve mono blocks (beasts! took 20 minutes warm up before you could play music, and 20 minutes on standby before powering off in order to preserve the 8 x 6550 valves per channel). But sound principles can go out of the window with hifi - we had a sound recordist at the BBC who swore by directional cables, cable lifters, high capacitance carbon fibre cables, separate hifi earth spike and those funny little Shakti stones that improved the sound immeasurably (!). And this was despite his BBC training!

-

Double post!!

-

Worth is a strange old concept... Some folks think that going to a gig with 50000 other people and paying £400 for the privilege is worth it. Others are happy to pay £500000 for a pokey flat in Willesden Green. I know a vastly overweight bloke who spent thousands on lightweight components for his Kawasaki while losing no weight of his own - it was worth it to him! And most bizarrely of all (arguably!), folks pay thousands for a personal number plate whose main two functions are to aid the police in recognising your motor, and to aid the public in determining the character of said number plate owner. At least with a high end vinyl set up you can attempt to appreciate your music in as much high fidelity glory as you feel it is worth! BTW, in my experience, a well put together and high quality turntable/arm/cart set up minimises surface noise of all kinds...

-

Indeed... Though I know hifi buffs who reject entire genres of music because it's not recorded in a sufficiently high fidelity way. As a result when you go to shows you tend to hear mainly wet ECM (or worse!) type jazz, or breathy female vocal stuff - it's mainly about listening to the soundstage, or bass extension, or air'n'space and "inky black silences". It's the hifi they're into, not the music! * *Though I'm a fine one to talk, I happened to look up my power amp recently and they're £13k now!!!

-

Maybe 40 years ago! A bottom end Rega RB220 is £265. If you want the top Rega it's £1500. My favourite tonearm, the Moerch DP6, is £2815 (I haven't got one!). An SME V will set you back five grand! And if you want a high end cartridge, a DS Audio Grand Master Extreme is £18995... Personally, I've got a slightly lower range SME arm on my very heavy acrylic Clear audio turntable with Audio Note cartridge through an EAR valve phono stage, and it sounds awesome. Though now that I've been reminded that I'm in denial I realise that it couldn't possibly sound any good, and will take it straight down to the charity shop...

-

There are hifi buffs who swear by Technics decks, spending thousands on arms, carts, isolation, "clean" power etc, though not many other turntable brands (not even EMT!) use direct drive motors, preferring the extra level of isolation a belt gives (on my TT the motor is in a separate very heavy billet aluminium cylinder, and a new belt is £50! Even Verdier use belts, despite having a magnetic bearing meaning the platter effectively levitates... Still, I've heard Technics decks sounding very good indeed.

-

Dizzy - Wonder Stuff

-

Rock Around The Crocs - Bill Haley and His Doofer

-

Stuck On You - Lionel Richie

-

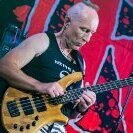

My (often funky)punk band has two bass players...